Where Does The Future Of Indian Auto Component IndustryLie? Let Us Take A Close Look

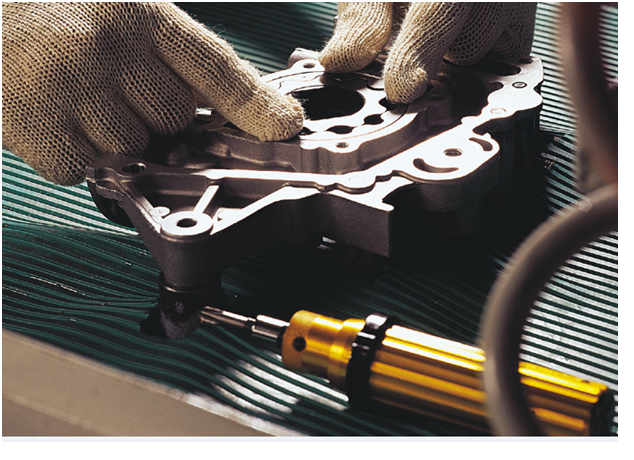

Today there are major automotive component manufacturers in India that produce “high quality Ferrous and Non-ferrous automotive components for highway, off highway and technology oriented applications for leading global automotive OEMs”. Some of these leading companies possess modern foundries in ferrous and non -ferrous alloys besides the latest facilities for the manufacture of automotive components both in India and Germany. It is on account of similar professional companies that despite the decline in the overall exports in the past, the exports in the Indian automotive components industry actually grew by an impressive “3.5 per cent to US $ 10.8 billion in 2015-2016”. Today the Indian automotive components industry faces the problem due to the cut throat competition in the global market where only the fittest shall survive.

According to an analysis by the Indian Auto Components Industry, the Indian automobiles market is soon going to be among the world’s largest and “will

account for more than 5% of the global vehicle sales”. It is obvious that it is on account of a continuous drive by the automotive manufacturing companies in India that this very impressive story has been made possible. The manufacturers of automotive components can similarly take credit for the robust growth posted by the sector. “The turnover is anticipated to reach US $ 115 billion by FY 2021 from US $ 35.1 billion in FY 2014.” It is forecast that the value of exports by automotive components could “account for as much as 26 per cent of the market by 2021”.

The Auto Policy for 2002 was indeed a very supportive policy for the automotive sector. This and the other policies did help strengthen the components’ industry which attained a good amount of growth. India today, is one of the major hubs for sourcing automotive components. A major point that supports Indian growth in respect of the components’ industry is that the country is strategically positioned with respect to the automotive market, especially those in Europe and the Middle East. The other point in favor of India is that its production is cost effective and it is this reason that has cut costs by between “10-25 per cent relative to operations in Europe and Latin America.”

Despite the cut throat competition faced by its automotive components industry, India has been successful in many ways. Firstly the French maker of automotive parts Valeo “plans to invest US $ 100 billion in India in the coming two to three years”. Secondly, the Canadian supplier of automotive parts Magna “plans to open 3 new plants in India by 2019”. With a booming automotive sector there are now “2 dozen global auto manufacturers setting up shop in India”. The forecasts indicate that the Indian market for automotive components will have a rate of growth that though moderate would still “remain double-digit at approximately 11%”. This figure is higher than the country’s growth rate of the GDP.