How Google Glasses and Smart Watches Will Change The Face Of Banking

Back in the 50s computers used to take half a room and that was considered the peak of human ingenuity and engineering. Fast forward to present day, and you can have a watch that has more processing power than mainframes from the days of yore. This is the most vivid example of the inexorable march of technology – so much progress compressed in such a small time frame. Imagine how long it took us to get to the first computers, and then in just a few short decades we have wearable devices that put even workstations of 20 years ago to shame.

But this is just the tip of the iceberg. With about 40% of the human population using the Internet, it’s just a matter of time before we can do everything using the World Wide Web. Technology companies are getting bigger, smarter and have more resource to push innovation at a faster rate than ever before. In just 10 years Apple has revolutionized the phone, tablet and music industry. With this fast passed transformation of technology, how are banks and financial companies going to keep up with delivering a service to their consumer’s online needs?

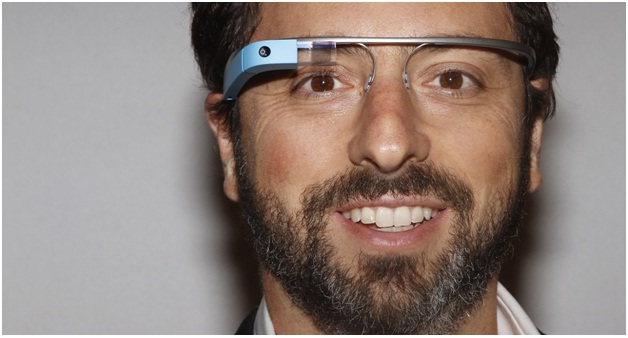

Google Glass and Smart watches are seen as game changers in the online/mobile sector. The systems are slicker, easier to use, convenient and change when and where we use the web. Many companies in the banking sector have only just got used to using mobile as part of their consumer journey. However successful mobile apps from banks are rare and there is still a lot of work to be done in order to enhance this channel.

Consumers now have the potential to access your bank account at any given moment via your smartphone. You can pay your bills, send money to a friend, pay your employees as well as complete all other standard bank transactions.

So how will the launch of Google Glass and the development of the Smart Watch build upon what mobile has already delivered. Well for a start both pieces of technology are less bulky and design focused compared to banking on a phone. Functionality needs to be simplistic and swift. This will mean that many banks will have to alter and improve their systems and procedures to ensure that all commands are extremely user friendly. This would mean the eradication of long login processes, confusing transactions and slow load times. Alex Bray from Misys says “There are already some interesting signs of activity. In fact, a few banks have already announced Glass applications – and we can glean some insights about the likely direction of future Glass based banking applications.”

Yet Sabadell isn’t the only bank to be developing Google Glass applications. PrivatBank in Ukraine has also developed a Glass App, as its Marketing Director Dmytro Duilet describes: “PrivatBank has become one of the first banks in the world to begin implementing QR codes and voice-activated control to its services on a large scale… The architecture of our applications suits Google Glass ideally. We don’t even have to adapt anything, everything is ready.”

However this is a very isolated case. I would go as far to say that with many banks barely grasping the concept and potential in the mobile and tablet market, the ability for them to embrace wearable technology will be beyond a miracle. Without the basic foundation of mobile and tablet being met, banks will never be able to deliver the experience consumers are looking for.

A bank which invests heavily into its innovation of mobile acquisition and into consumer journeys is a bank which breaks the online mobile and wearable vertical. A shift of resource into development and innovation needs to be made to improve the perception of the financial industry. So in conclusion, is Google Glass and Smart Watches going to change the face of banking. . . no . . . but does it have the potential to. . . a thousand percent!