7 Incredible Programs You Can Use to Track Your Personal Finances

It seems that we’ve been in an “economic recession” for about as long as anyone can remember. It’s no wonder people are looking for new, effective ways of determining where their finances stand on a personal level. For this reason, there are many programs out there centered on the concept of tracking and managing personal finances. Here are seven of the best:

This personal finance program, available as either a mobile app or an online tool, is remarkably simple, yet it performs an invaluable task: It helps you pay your bills on time. Modeled as a sort of alarm clock for bill playing, Check.me reminds you of when those payments are coming up, and also calculates what you are putting out towards bills in order to tell you, ahead of time, whether you are in the black or the red.

The YNAB (short for “You Need a Budget”) software is exactly what it sounds like: a program that helps you develop a budget. From your PC or Mac, YNAB will guide you through the sometimes complex process of budgeting, explaining (through tutorials) pertinent details along the way.

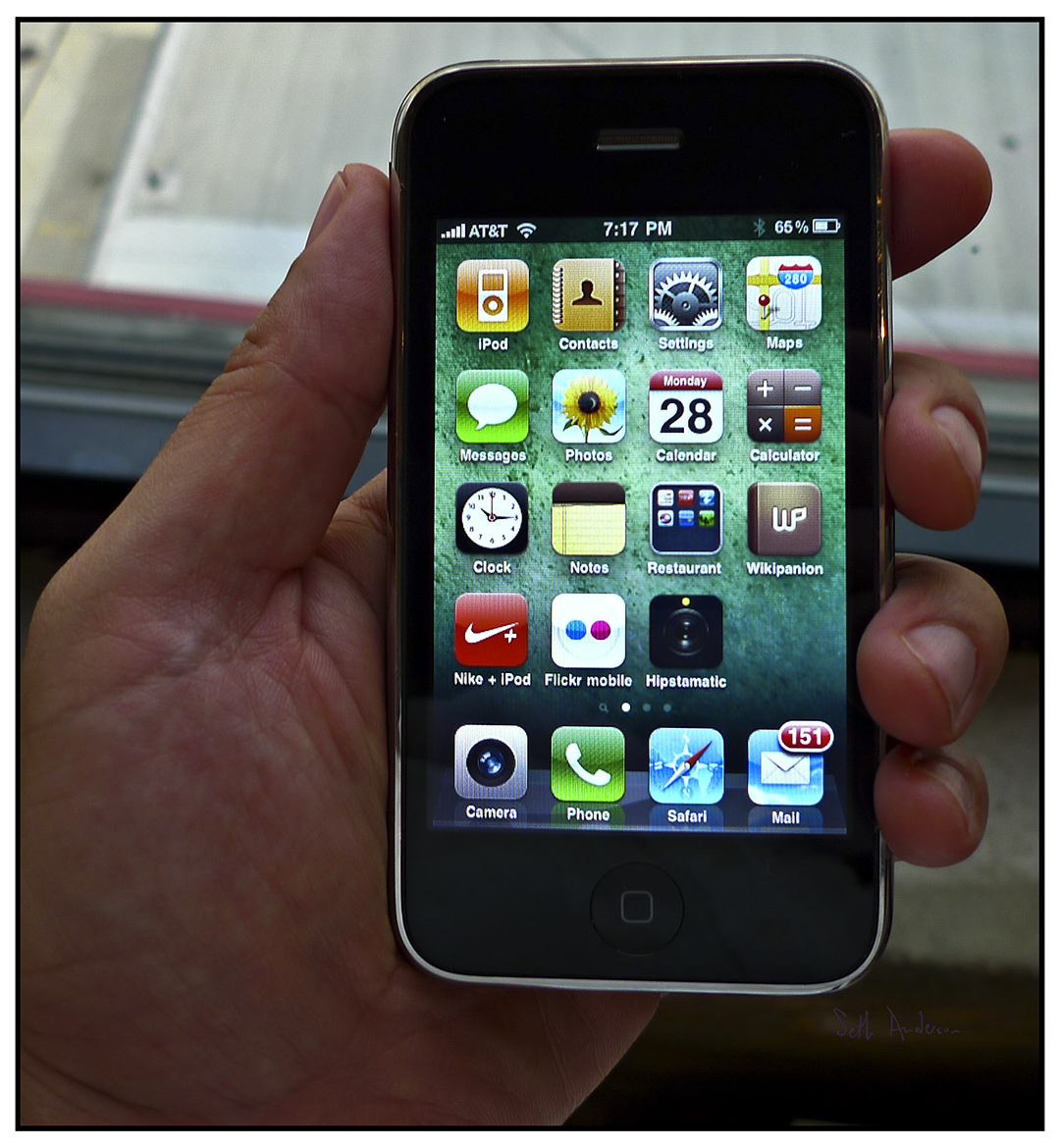

Available as either a software program or a mobile device app, Mint.com is one of the most widely recognized personal finance apps out there, and the widely touted preferred application on the top of many financial experts’ must-have lists. It has earned its reputation for good reason: Not only does it connect to each and every one of your accounts, but it also automatically categorizes your spending, help you set up a budget, and track your financial goals. Plus, it’s free!

If you have debt that you need to pay off, then this personal finance software is a great choice for your needs. Yodlee MoneyCenter is free for PC and Mac, so definitely worth trying if you could use a varietal program that does everything from track your net worth to report on outstanding balances and projected payoff time.

Think of this personal finance program as a digital filing cabinet–but one that you can link to all of your utility accounts. Doxo is a service run through a website (doxo.com), enabling you to store important documents, view upcoming bills, and even make payments from one interface.

How much time do you spend working, and are you getting paid for all of it? For many people who are self-employed, or who work on a contract or freelance basis, tracking work time is tantamount to receiving fair pay. Office Time makes this task simple by recording the billable hours you work and then preparing financial reports and invoices based on those hours.

This software is perfect for personal finance plans centered on paying down credit card debt. Not only does Zilchworks help you strategize a payment plan, but it also aids the negotiation process with lenders to help you get better terms.

As you can see, there is no shortage of personal finance programs on the market. No matter what your current financial standing is, you can be sure to benefit from the advantages of putting these programs to work for you. And if you still have questions, you can get started with your own new plan by visiting SmartAsset to ask additional questions as you think of them!