KAKEIBO Keeping Your Finances On Track, The Japanese Way

Japan is what makes you think about animé, bullet trains, cherry blossoms, sushi, and robots. But there is certainly more to the Land of the Rising Sun than food and amusement. Japan, being culturally rich and technologically advanced, is where the rest of the world can get and learn a handful of useful and helpful information and tips – from academics, politics, technology, to today’s latest madness-surrounded trend, the Japanese lifestyle.

In the recent years, Japan gave us the ancient tradition of Wabi-Sabi, the art of embracing the imperfect. Then came Marie Condo and her (The) Life-Changing Magic of Tidying Up which inspired the world to declutter or sort out shambles of our homes and chuck out anything that didn’t “spark joy”. All these worked pretty well – we learned how to, at least, clear one of our drawers. So, it makes perfect sense to do the same to tidy our finances that are in need of a little order; through, yet, another clever method from the Japanese: the art of kakeibo.

Pronounced as ka-kay-boh which literally means “household financial ledger” in Japanese, kakeibo is the Japanese art of saving based on a century-old financial concept that was first introduced by Motoko Hani, the first female journalist in Japan; when she published a kakeibo (accounting book designed for households) in a women’s magazine in 1904 with a belief that financial stability is important to happiness.

Since then, the kakeibo has gained the interest of the Japanese; and after 114 years, of the whole world – when it has been resurrected by Fumiko Chiba’s newly published book titled “Kakeibo: The Japanese Art of Saving Money” which had made everyone went gaga with an Instagram hashtag: #kakeibo.

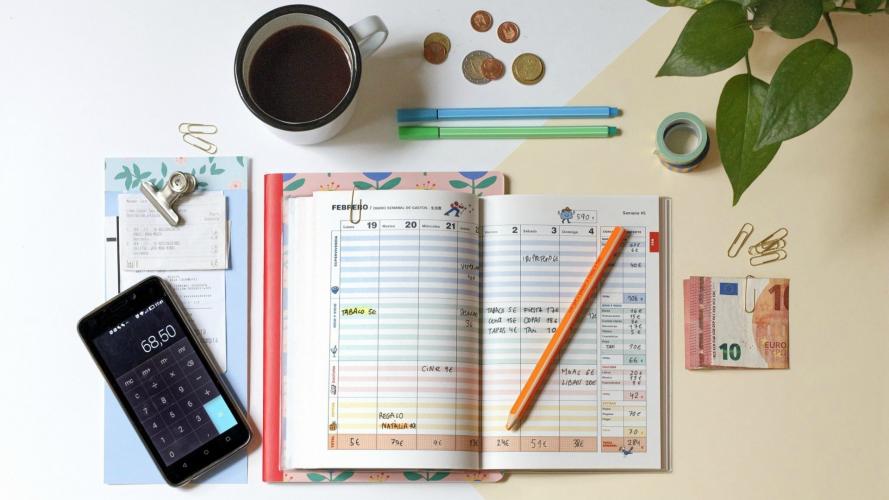

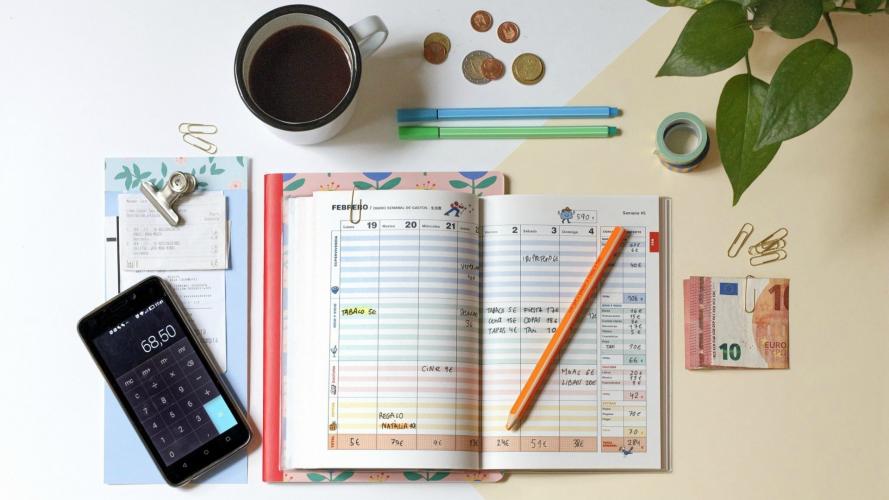

So, basically, kakeibo is a physical notebook where you will (diligently) record your saving pattern and keep track of the money coming in and going out. With a promise of 35% saving on the household finances, it is a simple way to make a big picture of your saving goals while monitoring your spending in a daily basis.

Although it might take you some time to get used to recording (writing) every expense, especially if you have been relying on budgeting apps for quite some time; you will find that using the Japanese accounting book is pretty easy.

Optional:restaurants, bars, shopping, and basically everything that has something to do with your social life;

Culture: movies, books, swimming lessons, and etc.; and

Extra: repairs, gifts, furniture, and all other things that you don’t have to regularly pay for.

The concept of kakeibo is based on the envelope system. That is, you can divide your income into categorized expenses either literally: making envelopes (i.e., survival envelope) and putting cash in them; or figuratively: writing them down in a ledger.

Write down your promises for the month (i.e., shop less, stop smoking, etc.).

At the end of the month (and the year), the difference between the initial budget and the total monthly expenses will give you the total monthly (yearly) savings. And as another month starts, you start to allocate money into the envelopes and the cycle begins again. Easy.

Like any other financial tracker, using a kakeibo will help you analyze and manage your income to better allocate your resources so you can be sure to get the most out of your paycheck. However, although it might not be as sexy as automated money-tracking web-based applications; it is, probably, more effective as it forces you to actively manage your personal finances and spend less than what you earn by setting up goals for yourself.

Stacey Tisdale, a behavioral finance expert, agrees that the concept and power of journaling bring goals back into our peripheral vision.

“We spend for lots of different reasons. What’s great about journaling is that you can start to really look at what’s really driving your financial behavior”, she said.

Moreover, its effectiveness is proven by some statistics showing that the household savings in Japan averaged 11.82% from 1970 until 2017 reaching an all-time high of 49.70% in December 2015 as compared to 3.3% of an average household in the U.K. and 4% of an average American.

Furthermore, the concept of kakeibo does not only hold true for the Japanese household but for the nation’s economic standing as well. Competing against the United States, which is currently the world’s largest economy; and China, its closest rival over many economically-related issues like Nanking, territorial disputes, and whose economic growth is partly explained by its longstanding saving culture like Japan – the art of saving certainly helps to continue vying for the top.

While a number of computer programs, excel templates, and apps are available on the go and can keep you from the hassle of writing; they are no match to the tangible sense that kakeibo gives of how you are managing your money.